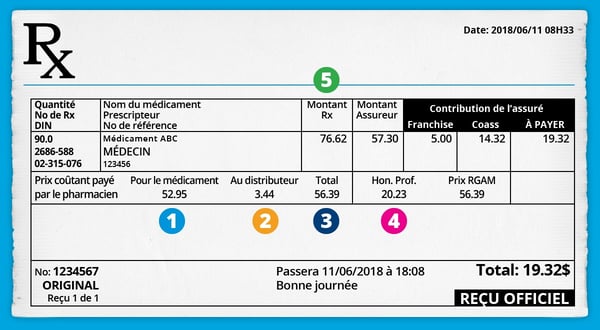

Pharmacy Invoice: Learn to Interpret It!

As of September 15, 2017, pharmacies are required to provide a detailed pharmacy invoice for prescription drugs purchased in Quebec and included in the list of RAMQ covered drugs. This law was put in place to provide the consumer with detailed information on the price of prescription drugs. However, the nuances between the various fees included in the pharmacy invoice may seem quite complex.

To help you find your way around, we offer you, in this article, an overview of the main aspects to better understand the information provided on your pharmacy invoice.

1. Cost price paid by the pharmacist

First, the cost price of the drug, shown on the sample pharmacy invoice above, is the price the pharmacist paid for the product itself. This amount does not include any profit margin and it is the same for customers insured under the public plan or a private plan.

2. Cost price paid to the wholesaler (distributor)

For its part, the amount paid to the wholesaler is the amount of 6.5% paid by the pharmacist to the distributor. This percentage is set by the government and does not include any profit margin for the pharmacist. It is the same whether you are insured under the public plan or a private plan. The distributor is the intermediary between the company that makes the drug and the pharmacy, i.e. the channel through which the drug is distributed.

3. Total

This total is the sum of the drug cost price plus the amount paid to the distributor. It represents the total price paid by the pharmacist for the drug. This total is also known as the “RGAM price” as it is equal to the price payable by the RAMQ for the drugs included on the RAMQ list. This amount does not include the fees paid to the pharmacist by the RAMQ.

4. Professional fees

This item represents the direct and indirect expenses related to the pharmacist’s professional services and the pharmacy’s continued operations, as well as the pharmacy’s profit margin. For drugs sold to private group insurance plan members, these fees are not set by the government, but rather determined by the pharmacist. For your information, according to information provided at a conference given by Telus in 2018, the average professional fees charged in 2017 in Quebec were close to $17.00. According to the same source, for the RAMQ public plan members, these fees amount to approximately $8.50.

5. Total payable

When you add the drug cost price, the amount paid to the distributor and the professional fees, you get the total price charged by the pharmacist. This is the amount used by the insurer to determine the reimbursement under the terms of the policy (deductible, maximum, user fee, co-payment, etc.).

Using the information found on your pharmacy invoice to your advantage

Pharmacists are highly regarded by the public and they provide important services, especially in a context where it is difficult to consult a doctor. However, they are also business people who set the price of their services based on economic considerations. Knowing a pharmacist’s fees provides private group insurance plan members with the information they need to assess whether the service provided is in line with the price they pay. If this is not the case, there are some alternatives.

In conclusion, keep in mind that it is as important to ask questions about the cost of your drugs as it is about all the different products that we consume regularly. Remember, the price of your prescription drugs greatly influences the cost of your insurance plan! Make sure to stay informed and understand the different components of your pharmacy invoices, it will help you make wise choices for the future!